Debt

Supporting with debt and money management

We provide one-to-one debt advice to help people work out how much they owe, which debts should be paid back first and how to resolve each debt. We are regulated by the Financial Conduct Authority, registered with the ICO and the Breathing Space Scheme, members of Advice UK and our senior debt advisers are approved intermediaries for Debt Relief Orders. Further information on free debt counselling, debt adjusting and credit information services can be found by contacting MoneyHelper:

https://www.moneyhelper.org.uk/en/money-troubles/dealing-with-debt/use-our-debt-advice-locator.

“There is a solution to every money problem.”

Debt Advice

We provide one-to-one debt advice to help people work out how much they owe, which debts should be paid back first and how to resolve each debt. We are regulated by the Financial Conduct Authority, registered with the ICO under the Data Protection Act and are members of Advice UK.

Money Management

We are passionate about improving people’s financial wellbeing and resilience. Our one-to-one money coaching and group financial capability courses give people the confidence to make the most of their money and improve their lives. Our money courses include the following key areas: Welfare benefits, bills, payslips, budgeting, savings, spending, marketing pressures which influence our buying decisions; taxation, borrowing money and insurance.

Creative Pathways to Smart Money

Our successful ‘Creative Pathways to Smart Money’ project was a two-year project to help people (aged 18 to 65) struggling with financial hardship and ‘mild to moderate’ mental health problems in Cornwall. The project received funded of £99,989.00 by Comic Relief. We delivered innovative financial literacy workshops based on client’s interests, which included art therapy, cooking, and growing your own fruit and vegetables, combined with one-to-one counselling; debt advice; and literacy and numeracy support. The project reduced client’s debts; improved their wellbeing and financial capability; and positively changed client’s behaviour towards spending and saving.

Money Smart

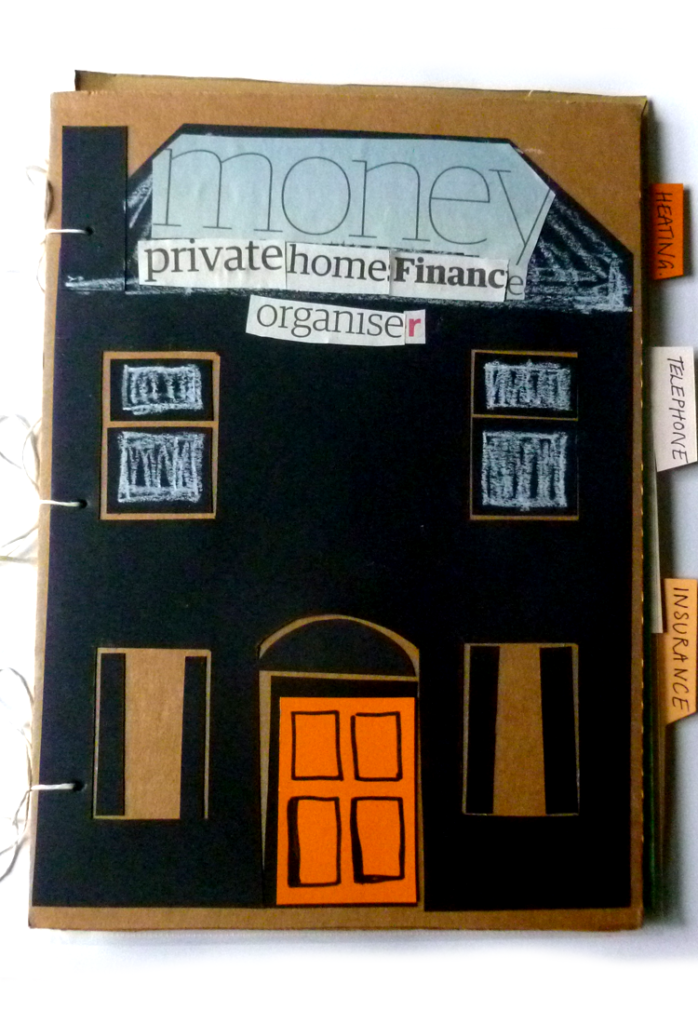

Our successful ‘Money Smart’ project was a one-year project funded by the RBS Natwest Skills and Opportunities Fund. Our fun and hands-on, financial literacy workshops used creativity and recycled materials to address adverse money habits and used practical tools to assist with personal budgeting. Each workshop included a theme and discussion around issues such as ‘short term fulfilment’, setting SMART money goals, understanding loans and APR, managing a personal budget, handling creditors, maximising income, and savings. The creative workshops were designed to be hands-on and based around hobbies. The group sessions ran alongside one-to-one debt advice and employment coaching.

Family Finance

Our six-week accredited family finance course was funded by the Britannia Foundation and is embedded with L1 and L2 Numeracy. Participants learnt about budgeting, income maximisation, savings, pensions, financial jargon, credit and debt management, whilst achieving a City & Guilds L1 or L2 Numeracy qualification.

Money management

Get help to deal with your debts, increase your income and manage a budget.

Back to work

Vocational training and employment support to help you reach your true potential.

Your wellbeing

Get help from our healthcare professionals to help you manage your health and wellbeing.